In a laudable move, the UK government recently unveiled a long-pending strategy designed to accelerate payments to small-and-medium-sized businesses (SMEs), with the ostensible goal of improving SME cashflow.

3PLs benefit from paying carriers sooner

While well-intentioned, new legislation alone will likely have a limited impact within our sector. That’s because many 3PLs already want to settle invoices sooner… because doing so means 3PLs can attract more and better carriers, improving resilience and service. Elsewhere, 3PLs who pay quicker might even expect favourable quotes during tenders. After all, carriers value prompt payments, and value is almost always rewarded financially.

It follows that our sector does not need legislation to speed up payments. What it really needs is a tool that removes the barriers that prevent 3PLs from settling invoices sooner.

TEG is that tool. In this post, I’m going to go through how it works.

How the TEG platform overcomes payment complexity

One major barrier to 3PL invoice settlement is operational.

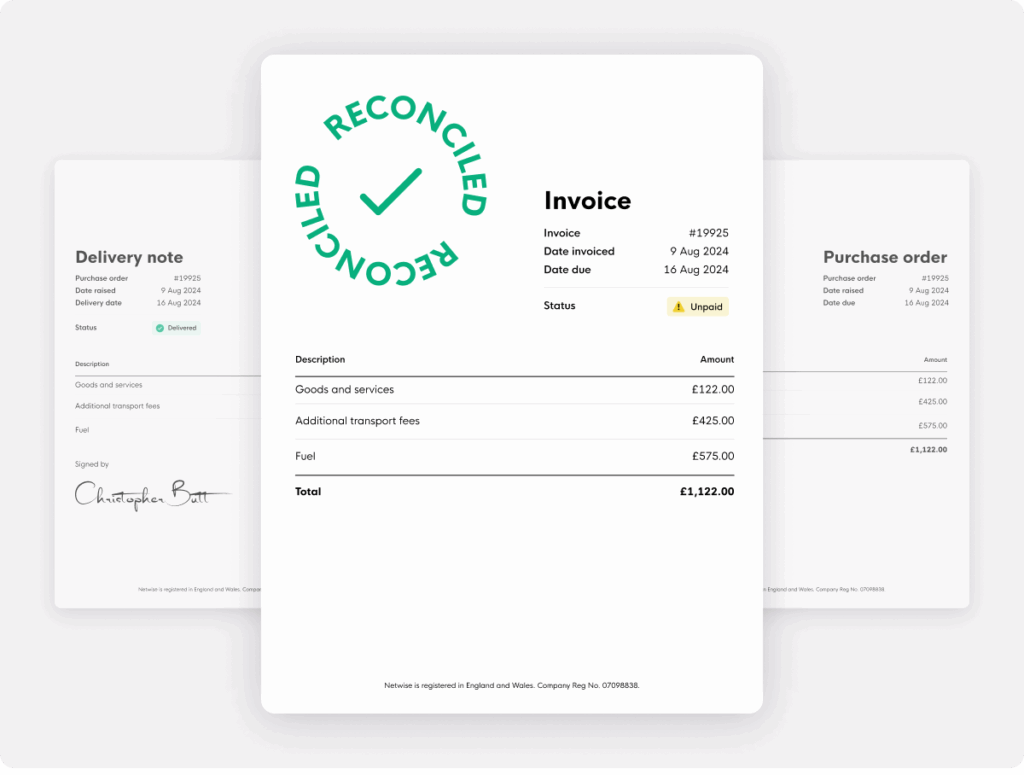

In most sectors, to settle invoices, customers need to match invoices to purchase orders. In the transport sector, customers (ie, 3PLs) need to match invoices to purchase orders and match PODs to the bundle.

The fragmented nature of the sector rarely makes this straightforward: some carriers submit PODs and invoices by mail; some send them by email; some submit PODs and invoices as separate emails; some email their PODs and invoices and send the same PODs and invoices physically; the list continues, and organising the chaos is a huge administrative undertaking.

Self-billing isn’t perfect

To overcome the chaos of reconciling invoices, PODs and purchase orders, 3PLs often turn to self-billing. They book carriers, then raise their own invoices. This works to an extent. But it has pitfalls in edge cases, such as when using new carriers, or carriers not on contracts, or when PODs aren’t clearly signed.

The TEG platform makes self-billing unnecessary

As a 3PL armed with the TEG platform, you allocate jobs to your carriers via the platform. The jobs, which include pick-up details, delivery details, and other relevant notes, are saved in-platform. Your carriers deliver the goods, then, at the point of delivery, send you a POD and an invoice through the TEG platform. No emails. No post. It’s all recorded in-platform, with a clear paper trail.

That means a job, its POD and its invoice are all auto-reconciled immediately. Both 3PLs and shippers can see all three documents, tethered together, in one screen.

TEG’s Freight Audit functionality automatically checks invoices for any discrepancies or abnormalities. Auto-approval settings allow 3PLs to approve non-discrepant invoices automatically, without lifting a finger.

The platform therefore eliminates the payment bureaucracy that slows transport payments… and overcomes the barriers to collaboration self-billing can sometimes erect. Better still, the fact carriers can see they’ve invoiced and the statuses of their invoices, there’s no need to call chasing payment updates.

How the TEG platform eliminates cashflow constraints

Still, a second barrier to speedy transport payments exists: cashflow.

While 60-day payment terms might seem lengthy to relatively small carriers, as you move further and further up in the supply chain, the terms become evermore lengthy. In the supply chain’s upper echelons, payment terms of 180 days aren’t uncommon. If 3PLs are going to settle invoices sooner, they need a cashflow solution.

Fortunately, the TEG platform has just that.

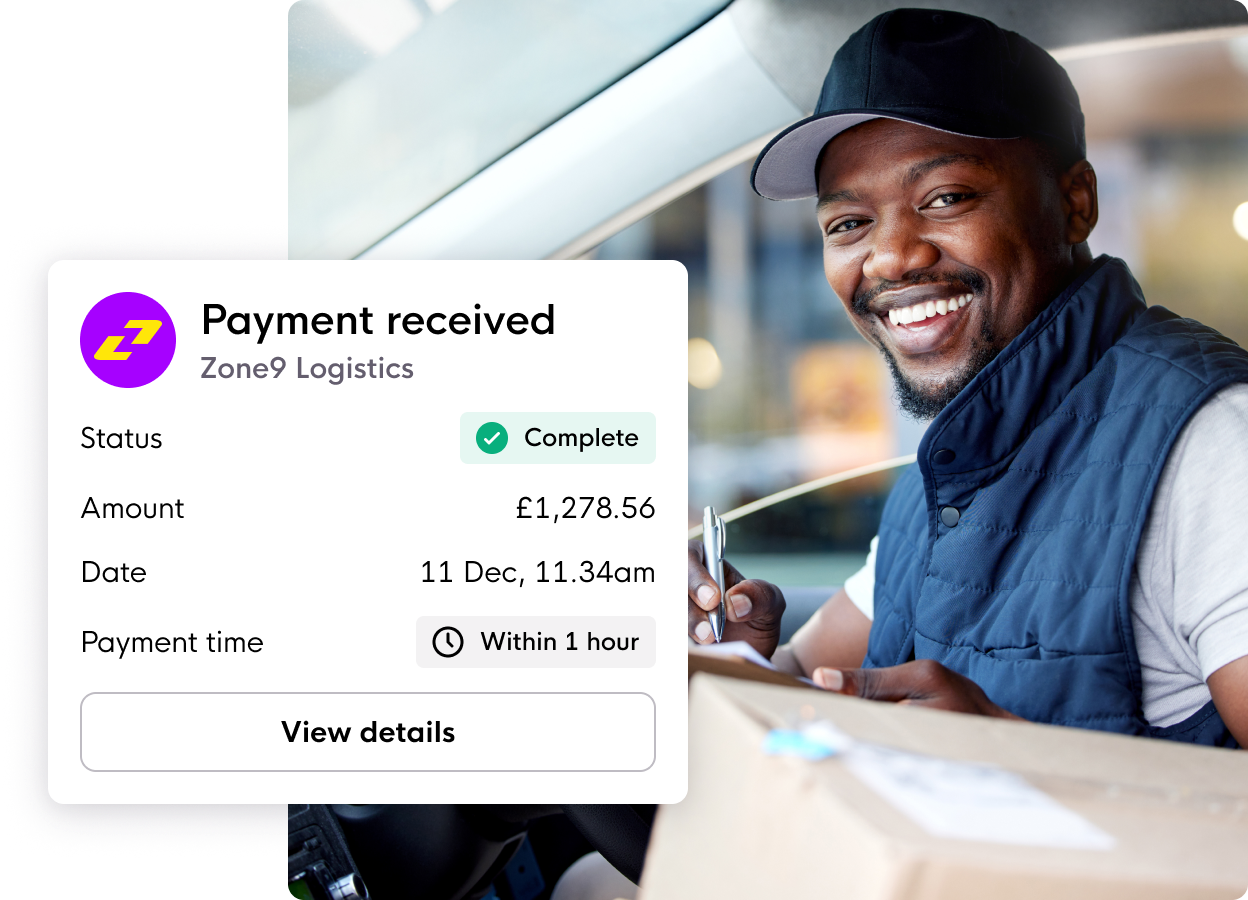

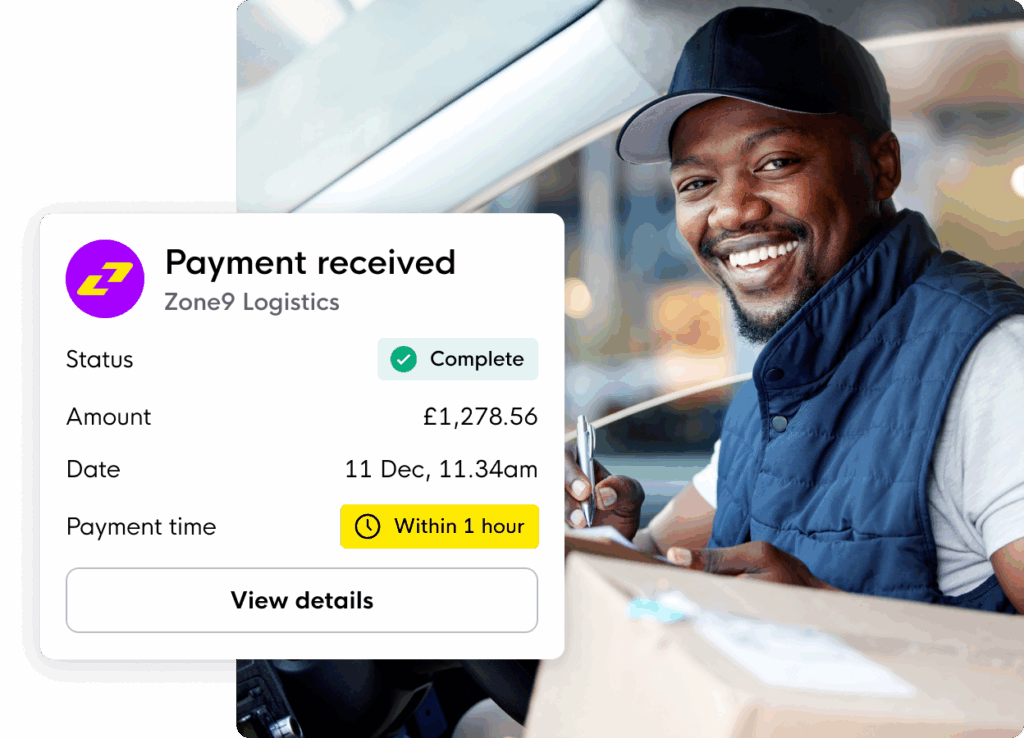

TEG offers carriers embedded finance

The TEG platform offers carriers embedded finance. That means, after delivery, once carriers have submitted a POD and an invoice (which can be auto-approved if non-discrepant – see above), they can request payment release within 60 minutes. It’s worth pointing out that 3PLs do not need to settle invoices within 60 minutes. As a 3PL, you stick to your original payment terms. The platform’s finance capabilities simply plug the gap, paying out to carriers early.

This costs 3PLs nothing. As icing on the cake, 3PLs who can settle invoices sooner receive a rebate. In effect, then, as a 3PL, you can make money from settling invoices sooner.

The real accelerant

While the government’s new payment reforms should be welcomed, they cannot solve the unique challenges of our industry. Technology, however, can.

With tools like the TEG platform, 3PLs and carriers alike are finding that faster, more reliable payments are not a legislative goal but a present-day reality. The new era of transport payments has arrived.